Shopify payment gateway – stripe vs paypal (hong kong)

Besides Shopify Payment Gateway (although it is not supported in all countries), there are plenty of 3rd party payment gateway integrated with Shopify. Stripe and Paypal would be the entry point for most of the new eCommerce joiners due to the ease of the on-boarding process. In Shopify, no matter using Paypal or Stripe, you don’t have to worry on the security aspect as both providers are PCI compliance.

In this article, we would like to go in-depth to compare the two payment gateways in Shopify. In general, the information is applicable to worldwide, except the transactions related information are based on Hong Kong Paypal to produced.

Whether Paypal or Stripe is better as a 3rd party Shopify payment gateway?

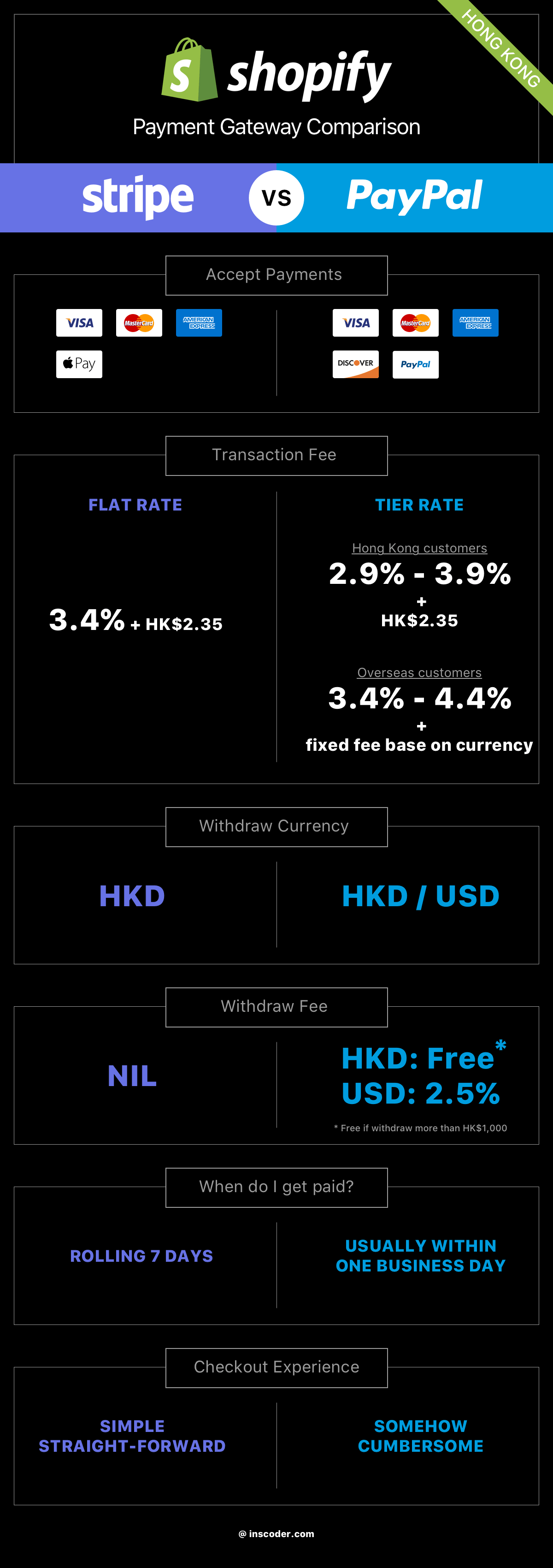

Both Paypal and Stripe support the major credit cards – VISA, MasterCard and American Express. Stripe have an advantage as it support the latest ApplePay technology. On the other hand, Paypal have already built the trust with over hundred million customers worldwide. As a merchant, we should not give up any chance on losing a customer. Both Stripe and Paypal have their own advantage, luckily, Shopify allow us to integrate both payment gateway in one store.

Transaction and services fees

Stripe adopts a simple approach – flat rate. In Hong Kong, they charge 3.4% + HK$2.35 per successful payment. The rate varies country by country, but still charged by a flat rate. Withdrawing money to the local bank HKD account is free. However, note that stripe by default schedule the transfer in a rolling 7 days basis, that mean you can only receive the payment more than 7 calendar days after the transaction is completed.

Paypal, on the other hand, charges by tier rate from 3.9% down to 2.9% + HK$2.35 for local currency transaction in Hong Kong. To deal with oversea customers, Paypal charge as high as 4.4% down to 3.4% plus a fixed fee based on the currency received. Withdrawing money to local bank HKD account is generally free, unless you transfer less than HK$1,000. However, 2.5% handling fee will be imposed if you transfer to local bank USD account. Paypal usually complete the transfer within one business day.

Obviously, stripe is more transparency and simple in this area.

Customer experience during checkout in Shopify

When using Stripe, the checkout process is very simple and straight-forward. Customer will go through the normal flow (Cart > Customer Information > Shipping Method > Payment Method) and choose the final payment method after calculated the shipping fee.

After you integrated Paypal Express Checkout, there is an big yellow button “Checkout with PayPal” in you cart page and the first checkout page (known as Customer Information page). If the customer click on it, Shopify will popup the Paypal login screen for customer to select the debit details. At this moment, they still do know the shipping fee yet. This created the confusion to customers and increase the abandoned checkouts. Well, PayPal does not charge the customer at this time, but bring back the customer to continue the check processes (Shipping Method -> Payment Method). At the last step, customer could confirm to make the payment via PayPal or other methods.

This is controversial. Some shop owners like the way Paypal help their customer to pre-fill the email, address, etc. On the other hand, we heard many merchants want to kill this button for long. You have a choice now, check out our app – Hide PayPal Cart in Shopify App Store.

Conclusion

Stripe and PayPal are excellent and secured payment gateway, both have their own strengths and weakness. You have to review which one best suits for your store. Well, you can also integrate both of them to take all the benefits.

*** If you want to experience the different checkout process between using Stripe and PayPal, just drop us an email. We can arrange the demo shops for your to play around.

You can find the app by clicking the following link: https://apps.shopify.com/connected-inventory?ref=inscoder